All Blogs

FinTech App Security: The 10 Most Common Vulnerabilities You Can’t Ignore

Quick Overview: Cyber threats are evolving rapidly, and applications remain prime targets. This blog explores the top 10 security vulnerabilities, their impact, best practices for mitigation, and how businesses can strengthen app security to protect data, customers, and long-term growth.

FinTech applications are transforming how people manage money—powering everything from mobile wallets and investment platforms to instant loan approvals and cross-border payments. The industry is booming, with global FinTech revenues expected to be worth USD 394.88 billion in 2025 and reach USD 1,126.64 billion by 2032. But with this meteoric growth comes an equally rapid rise in cyber threats. Where there’s money, there’s always a hacker lurking.

Unlike traditional apps, FinTech platforms hold a goldmine of sensitive data: payment card details, bank account credentials, identity verification documents, and transaction histories. For attackers, breaching a FinTech app isn’t just about stealing data—it’s about gaining direct access to cash flows and exploiting trust in financial systems. Unsurprisingly, reports show that over 60% of FinTech firms experienced at least one security incident in the past year, often leading to financial loss, regulatory fines, and damaged reputations.

The problem isn’t just the hackers’ ingenuity—it’s the FinTech application security vulnerabilities hidden within themselves. From broken access controls that let malicious actors move funds, to insecure APIs leaking customer data, these weaknesses create open doors into systems that should be impenetrable. Add the complexity of third-party integrations, cloud infrastructure, and evolving compliance requirements (like PCI DSS 4.0 and regional data privacy laws), and the attack surface grows even larger.

This blog explores the Top security vulnerabilities found in FinTech applications. Also, we’ll break down why these flaws occur, how they can impact financial services, and most importantly, the technical best practices you can apply to mitigate them.

Already using ZeroThreat to secure your FinTech applications? Log in and run your latest scans today. Sign In Securely

On This Page

- Understanding the Cybersecurity Threat Landscape in FinTech

- Most Common Threats for FinTech Companies

- OWASP Top 10 Vulnerabilities in FinTech Apps and How to Mitigate Them

- Common Tips for Enhancing FinTech App Security Solutions

- How ZeroThreat Helps You Address FinTech Cyber Security Challenges

- Conclusion

Understanding the Cybersecurity Threat Landscape in FinTech

FinTech applications are all about having money, sensitive data, and trust, making them prime cyber targets. With third-party APIs and cloud-first adoption, the attack surface grows wider than traditional banking systems.

Web app exploits, API abuse, and credential attacks dominate breaches, while misconfigurations and insider risks add fuel. Coupled with evolving regulations like PCI DSS and GDPR, FinTech firms must treat every transaction and API call as a potential attack vector and secure accordingly.

Most Common Threats for FinTech Companies

FinTech firms face a unique mix of traditional financial risks and modern cyber vulnerabilities. Below are the most common threats impacting the sector:

- Account Takeovers (ATO): Attackers use stolen or brute-forced credentials to hijack user accounts and steal funds.

- API Exploits: Poorly secured APIs expose sensitive customer data or allow unauthorized transactions.

- Broken Access Control: Weak role validation lets attackers escalate privileges or access other users’ data.

- Cloud Misconfigurations: Publicly exposed storage buckets, overly broad IAM roles, or unpatched servers create easy entry points.

- Phishing & Social Engineering: Customers and employees are tricked into disclosing login or MFA details.

- Insider Threats: Malicious or negligent employees misuse privileged access to leak or manipulate data.

- Business Logic Abuse: Fraudsters exploit workflows (e.g., promo codes, transfer limits, KYC bypass) not properly safeguarded.

FinTech app cybersecurity threats not only expose sensitive data but also erode customer trust, trigger regulatory fines, and disrupt business continuity.

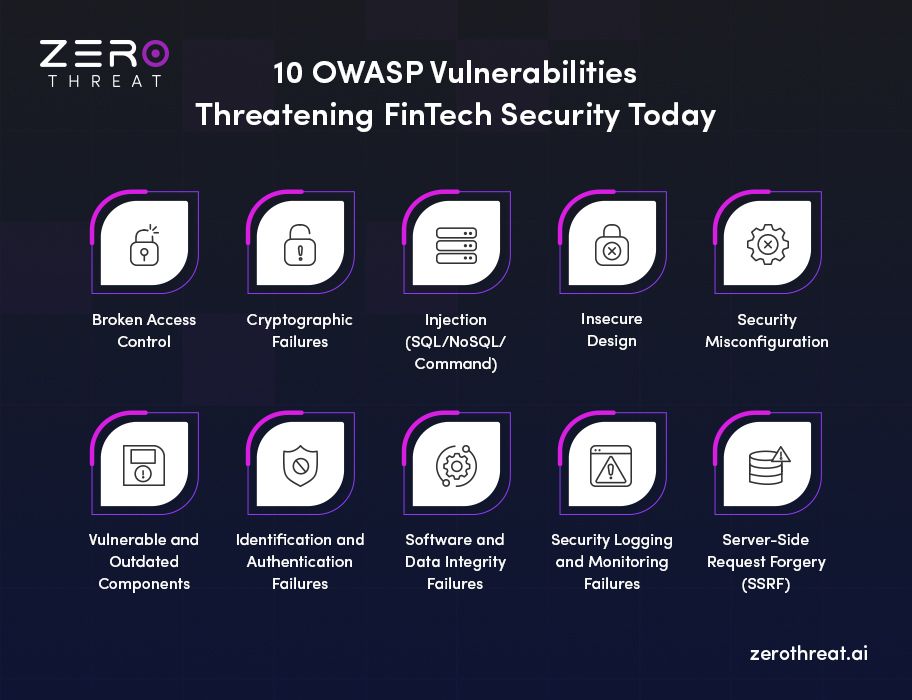

OWASP Top 10 Vulnerabilities in FinTech Apps and How to Mitigate Them

The OWASP Top 10 is a global web app security testing standard to identify the most critical risks. Aligning security practices in FinTech is essential for safeguarding financial data, preventing fraud, and staying compliant with regulations. Let’s break down each category and outline actionable mitigation strategies:

Broken Access Control

Threat: Users gain unauthorized access to accounts, admin panels, or financial transactions. In FinTech, this could allow attackers to transfer funds, view customer records, or escalate privileges.

Mitigation: Implement server-side authorization checks, enforce least privilege policies, validate object ownership (to prevent BOLA/IDOR attacks), and test with role-based scenarios. Regularly audit authorization rules using policy-as-code frameworks.

Cryptographic Failures

Threat: Poor or outdated encryption exposes sensitive data such as credit card details, API keys, or PII.

Mitigation: Enforce TLS 1.2+, use FIPS 140-3 validated crypto libraries, and rotate keys with KMS/HSM solutions. Replace custom crypto with industry-standard algorithms. Mask or tokenize cardholder data to reduce PCI scope.

Injection (SQL/NoSQL/Command)

Threat: Unsanitized inputs allow attackers to manipulate queries, execute unauthorized commands, or exfiltrate financial data.

Mitigation: Adopt parameterized queries or ORM safeguards, apply strong input validation, and enforce query allowlists. Automate testing with injection payloads in CI pipelines to block regressions.

Insecure Design

Threat: Business logic flaws (e.g., bypassing KYC, exploiting withdrawal-before-settlement) let fraudsters abuse workflows.

Mitigation: Conduct threat modeling for financial transactions, design workflows with abuse cases in mind, and require step-up authentication for high-value actions. Integrate security early in SDLC (“shift-left”).

Security Misconfiguration

Threat: Default passwords, open S3 buckets, or verbose error messages expose systems. In cloud-first FinTech, misconfigs are among the top breach causes.

Mitigation: Automate configuration scanning with IaC tools, enforce least privilege IAM policies, disable unused services, and apply security headers (CSP, HSTS). Regular penetration tests should validate cloud deployments.

Vulnerable and Outdated Components

Threat: Exploitable libraries or SDKs allow attackers to hijack applications through known CVEs.

Mitigation: Maintain an SBOM (Software Bill of Materials), run continuous SCA (Software Composition Analysis), patch according to KEV catalog urgency, and avoid unsupported libraries. Enforce dependency pinning and automatic update pipelines.

Experience how AI-powered scanning simplifies FinTech cybersecurity. Request a personalized demo today. Schedule My Demo

Identification and Authentication Failures

Threat: Weak MFA, long-lived sessions, and poor credential management lead to account takeovers.

Mitigation: Use phishing-resistant MFA (FIDO2/WebAuthn), secure session management (short TTL, rotation, binding to device/IP), and employ brute-force detection mechanisms. Follow NIST 800-63B standards.

Software and Data Integrity Failures

Threat: Supply chain attacks, malicious code updates, or tampered CI/CD pipelines introduce backdoors into FinTech apps.

Mitigation: Digitally sign software artifacts, verify integrity with checksums, and secure CI/CD pipelines with signed commits and restricted build permissions. Vet third-party SDKs before integration.

Security Logging and Monitoring Failures

Threat: Lack of visibility allows fraud and breaches to go undetected, delaying response.

Mitigation: Centralize structured logging, log high-risk events (beneficiary adds, fund transfers, login failures), and integrate with SIEM for real-time alerting. Perform regular incident response drills.

Server-Side Request Forgery (SSRF)

Threat: Attackers abuse server requests to internal systems, gaining access to metadata services, APIs, or sensitive infrastructure.

Mitigation: Blocklist internal IP ranges, enforce allowlists for outbound requests, and apply network segmentation. Use metadata service v2 tokens on cloud providers to prevent SSRF to instance credentials.

Common Tips for Enhancing FinTech App Security Solutions

Building a secure FinTech application requires more than compliance checklists—it demands a proactive, layered approach to defending against evolving cyber threats. Here are ten actionable tips to strengthen your app security:

Enforce Strong, Phishing-Resistant Authentication

Authentication and authorization is the first line of defense against account takeovers, which is one of the most common FinTech app security vulnerabilities. Attackers exploit credential stuffing, phishing, and SIM-swapping to gain unauthorized access. To counter this, you must adopt phishing-resistant MFA methods such as FIDO2/WebAuthn or hardware tokens. By securing authentication, you significantly reduce the risk of fraud and identity compromise.

Secure APIs by Design

API security vulnerabilities in FinTech are the fastest-growing attack vectors. To secure them, you need to adopt schema validation for all requests and responses, enforce rate limiting to stop brute-force and enumeration attacks, and apply HMAC request signing to verify authenticity. Since APIs often serve mobile apps, add device attestation and short-lived tokens to prevent replay attacks.

Integrate Security into the SDLC

To overcome security vulnerabilities in FinTech applications, you must integrate them into every stage of the SDLC. Embed SAST, DAST, and API security testing into CI/CD pipelines to catch flaws before release. Developers should follow secure coding practices, with code reviews including a security checklist. By “shifting left,” vulnerabilities are identified earlier, reducing remediation costs and improving overall software quality.

Establish Real-Time Monitoring and Alerts

Many FinTech cybersecurity risks remain undetected for weeks due to insufficient logging and monitoring. In fact, you can use SIEM platforms to aggregate data, detect anomalies, and generate real-time alerts. Adding behavioral analytics helps identify account takeovers, API scraping, or fraud attempts that bypass static rule-based detection.

Educate Users and Staff

Employees with privileged access and customers using weak practices (like reusing passwords) create openings for attackers. Therefore, it’s essential to provide security awareness training for staff to recognize phishing, social engineering, and insider threats. For customers to overcome FinTech security challenges, use in-app nudges to promote good practices—like enabling MFA, avoiding public Wi-Fi for transactions, and recognizing scam messages.

How ZeroThreat Helps You Address FinTech Cyber Security Challenges

Since finance applications consist of sensitive data, fintech security issues are always higher. Traditional security tools often fail due to false positives, a lack of contextual insights, and an inability to handle modern cloud-native, API-driven architectures. This is where ZeroThreat brings a game-changing advantage.

AI-Powered Vulnerability Detection with Near-Zero False Positives

ZeroThreat leverages advanced AI models to detect vulnerabilities in your FinTech apps with over 98.9% accuracy. It also eliminates the noise of false positives. This ensures your security and DevOps teams can focus only on genuine, high-risk threats that directly impact customer trust and compliance.

Seamless Integration with DevSecOps

ZeroThreat integrates seamlessly with your CI/CD workflows, automating scans at every stage of development. This means security flaws in FinTech applications are caught before deployment, drastically reducing remediation costs and preventing disruptions to innovation.

MFA and Compliance-Ready Scanning

ZeroThreat supports Multi-Factor Authentication (MFA) and authenticated scans, allowing you to test real-world environments exactly as users would access them. This ensures accurate assessments and compliance-ready security.

Scalable, Cloud-Native Architecture

Whether you are a FinTech startup or an enterprise bank, ZeroThreat’s cloud-native architecture scales with your needs. From scanning a single app to thousands of APIs across regions, the platform ensures high-performance testing without slowing down operations or requiring complex configurations.

Choose ZeroThreat as your go-to automated pentesting tool in web application security, where we focus on developing and sustaining user confidence through thorough and dependable testing.

Curious about your app’s security posture? Run a vulnerability scan and spot OWASP Top 10 risks instantly. Start Free Scan

Conclusion

Securing FinTech applications goes far beyond meeting FinTech compliance security risks; it’s about protecting customer trust, ensuring seamless transactions, and staying ahead of evolving cyber threats. From OWASP Top 10 vulnerabilities to advanced attack vectors like API abuse and insider threats, the risks are real and growing.

By adopting proactive security practices for app security and leveraging advanced web app security testing solutions like ZeroThreat, FinTech companies can achieve resilient defenses, reduce false positives, and innovate with confidence. In a digital-first financial world, security is your strongest currency.

Frequently Asked Questions

How can I ensure my FinTech app is secure from OWASP Top 10 threats?

To mitigate vulnerabilities in FinTech apps before attackers exploit them, you must implement secure coding, conduct regular vulnerability scans, integrate automated security testing into CI/CD, and adopt tools like ZeroThreat.

Which OWASP Top 10 threats are most common in FinTech applications?

How do OWASP Top 10 vulnerabilities impact mobile banking security?

What regulatory fines can result from ignoring OWASP vulnerabilities in financial apps?

What’s the best way to test a FinTech app for OWASP Top 10 vulnerabilities?

Explore ZeroThreat

Automate security testing, save time, and avoid the pitfalls of manual work with ZeroThreat.