All Blogs

Penetration Testing in Banking: Protecting Data, Trust, and Compliance

Quick Overview: This guide explains penetration testing in banking, covering its role in securing apps, APIs, core systems, and cloud environments. It highlights common vulnerabilities, testing types, compliance needs, and recommended frequency. It will help you learn stages of pen testing and how it can help you stay protected against cyber threats.

The technology used for banking is transforming rapidly. Digital banking apps, APIs, cloud services, and fintech integrations are now essential more than ever. But along with that comes the increasing risk of cyber-attacks.

When the banking system, starting from web applications and APIs to core systems, are not tested well, problems arise. That’s why financial institutions are investing more than ever in detecting risks early and keeping customer data safe.

One of the ways to know the potential exploitation that can be done to the banking system is to simulate it before the real attack. And that’s exactly where penetration testing comes into the picture.

As of Q1 2025, the global penetration testing market is already valued at about USD 2.34 billion and is growing fast. So, if you want to learn more about it, we’ll cover everything from what exactly pen testing in banking is, its types, to stages of testing and more. So, let’s jump in to know more.

Start Testing Your Banking Application Before It's Too Late Explore Pricing

On This Page

- What is Penetration Testing in Banking?

- Why Do Bank Apps Need Penetration Testing?

- The 7 Types of Penetration Testing in Banking

- Common Vulnerabilities Found in Banking Apps

- Required Security Compliance for Banking Institutions

- Stages of Penetration Testing for Banking Applications

- Cost & Frequency of Banking Penetration Testing

- How ZeroThreat Helps Banks Secure Their Systems

- Final Thoughts

What is Penetration Testing in Banking?

Penetration testing in banking involves a security assessment where ethical hackers simulate real-world attacks to find and fix vulnerabilities in financial systems. Pentesting helps you find critical vulnerabilities in bank’s digital systems, such as online banking applications, APIs, payment gateways, mobile apps, and internal networks before malicious actors can exploit them. It helps to protect customer data and maintain customer trust, ensuring compliance with regulations.

Plus, when it comes to penetration testing in FinTech or banking, the stakes are even higher. Banks and FinTech handle sensitive financial data, customer identities, and billions in transactions every single day.

A single vulnerability in a core system, internet banking app, or payment API can open the door for hackers to exploit. That’s why penetration testing has become a critical layer of defense in modern financial institutions.

A proper banking penetration test looks at:

- Banking Applications (Web apps and mobile apps where customers log in, transfer funds, or make payments)

- APIs (used in fintech integrations and open banking platforms)

- Core Infrastructure (servers, databases, and networks running daily operations)

- SWIFT Systems (international money transfer platforms targeted by attackers)

- ATMs and Payment Systems (often exploited through hardware and software weaknesses)

As per today’s demand, maintaining security, especially in banking, is a must. It’s also required to build trust among customers by protecting their money and personal data. And leadership teams know that preventing a data breach is far less costly than cleaning up after one.

Why Do Bank Apps Need Penetration Testing?

Bank applications are prime targets for attackers. They process payments, store personal details, and give direct access to money. That makes bank applications one of the most attractive entry points for fraud and data theft. And even a single exploitable endpoint in the banking security system can lead to massive financial losses.

Regulators also expect banks to test their systems regularly. Standards like GDPR, PCI DSS, OWASP, FFIEC, and MAS TRM all require strict checks on banking applications. Penetration testing helps banks ensure compliance and avoid penalties that come with failing audits.

And beyond compliance, it’s about reputation. Customers trust their bank with sensitive data and hard-earned money. If that trust is broken, it’s almost impossible to win it back. By running penetration tests on their applications, banks can improve security, which leads to protected user data and money.

Know the Threat Before Attackers Do with Automated Pen Testing Start Testing Now

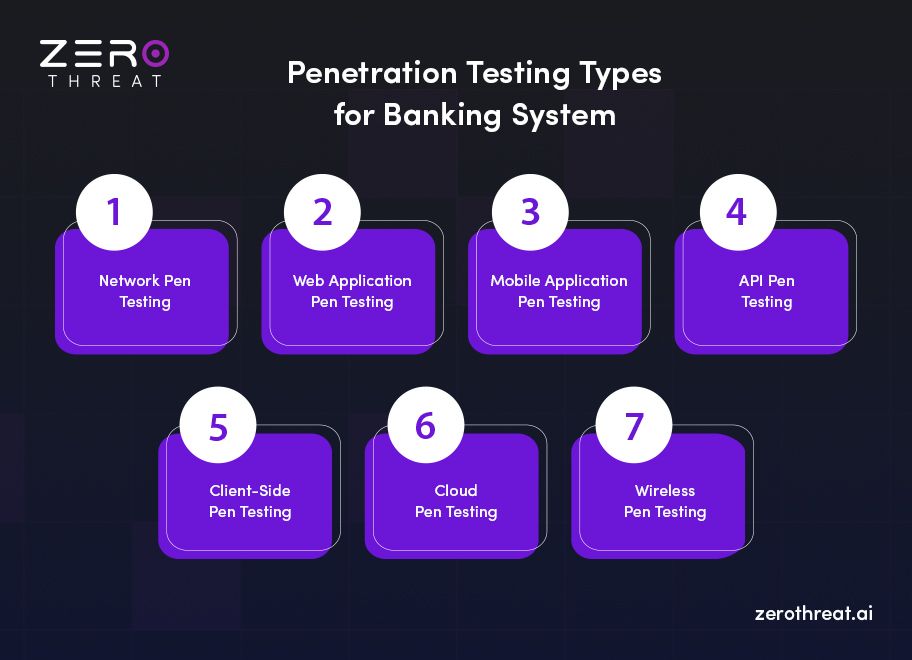

The 7 Types of Penetration Testing in Banking

There are various types of pen testing based on what your target is. Here are some of the key endpoints that you should never miss for penetration testing.

1. Network Pen Testing

Banking networks are the backbone of every digital transaction. A single misconfigured firewall, open port, or weak internal control can give attackers an easy path inside. Network penetration testing helps uncover these risks by simulating real-world intrusions.

Key areas this test includes:

- Firewalls, routers, and switches that control traffic

- Internal networks that connect employees, branches, and data centers

- VPNs used by staff and third parties

For banks, this testing is essential to protect core banking systems so that no sensitive data can be breached.

2. Web Application Pen Testing

Every internet banking portal is a high-value target. Customers log in, transfer money, and update personal details all from a web interface. That’s why web application penetration testing is critical.

It focuses on vulnerabilities like:

- SQL injection that exposes customer data

- Cross-site scripting (XSS) that hijacks sessions

- Broken authentication or poor session handling

This testing is also part of meeting information security compliance in banking, enforced by PCI DSS and other regulators.

3. Mobile Banking Application Pen Testing

Today, most customers prefer banking through mobile apps. But with that convenience comes new attack surfaces. Mobile banking application penetration testing evaluates how secure these apps are on both iOS and Android devices.

This type of testing looks at:

- Insecure data storage on the device

- Weak authentication and missing multi-factor security

- Flaws in communication between the app and backend APIs

It’s a direct way to protect customer data in banks with penetration testing while offering a safe mobile experience.

4. API Pen Testing

Every web/mobile app uses APIs for data retrieval. However, if APIs are not secured, they can expose sensitive customer data or allow fraudulent transactions. API penetration testing for banking ensures that these connections are safe.

Typical risks that are known:

- Broken authentication in open banking APIs

- Sensitive data exposure through poorly designed endpoints

- Insecure integrations with third-party fintech services

By testing APIs, banks protect themselves from one of the fastest-growing attack vectors in digital banking security.

5. Client-Side Pen Testing

Client-side testing focuses on software and systems running on a user’s device. For banks, this means checking desktop applications, employee workstations, and even customer-facing apps. Attackers often exploit weaknesses in browsers or local software to launch targeted attacks.

Common security risks on the client-side include:

- Malicious scripts that execute in the browser

- Outdated software on employee systems

- Flaws that let attackers bypass client-side controls

By running client-side penetration testing, the risk of phishing-based attacks and malware infections can be reduced with remediation.

6. Cloud Infrastructure Pen Testing

Most modern banks and FinTechs rely heavily on cloud services. While cloud platforms offer scalability, they also introduce unique risks. Cloud infrastructure penetration testing identifies misconfigurations, weak access policies, and insecure integrations that could expose banking data.

Areas typically tested here include:

- Identity and access management controls

- Stored data and encryption policies

- API connections between cloud apps and core banking systems

This type of testing helps ensure compliance with regulatory penetration testing requirements for banks and protects against breaches caused by cloud mismanagement.

7. Wireless Pen Testing

Banks rely on wireless networks in branches, ATMs, and offices. Wireless penetration testing helps spot weaknesses in encryption, authentication, and access control across these networks.

Key issues often found are:

- Weak WPA/WPA2 encryption

- Unauthorized rogue access points

- Poorly segmented guest or employee Wi-Fi

Testing wireless environments is important for banking cybersecurity testing, as attackers often target these overlooked networks.

Common Vulnerabilities Found in Banking Apps

Even the most advanced banking apps can have hidden security flaws. These weaknesses often become the entry points for fraud and data breaches. Here are some of the most common vulnerabilities that security platforms uncover during banking application penetration testing:

- Weak Authentication and Authorization: Poorly managed access controls and broken authentication make it easier for attackers to take over accounts.

- Insecure API Endpoints: APIs are the backbone of digital banking. If not secured, they can expose sensitive data or allow unauthorized transactions.

- Poor Session Management: Weak session handling can let attackers hijack active user sessions and gain control over accounts.

- Data Leakage Through Logs: Misconfigured logs and verbose error messages may reveal sensitive details about customers.

- Insecure Data Storage: Storing personal or financial data without encryption puts customer information at risk if devices or servers are compromised.

- Outdated Protocols: Using outdated SSL/TLS versions or weak cryptography leaves banking data vulnerable when in transit.

- Cross-Site Scripting (XSS): If the inputs are poorly sanitized, they allow attackers to inject malicious scripts, often targeting customer web sessions.

- SQL Injection: Improperly validated inputs can expose databases to attacks, risking financial and personal data.

- Insecure Third-Party Integrations: Banking apps often connect with fintech platforms. If integrations aren’t tested for security, they can become weak endpoints.

- Improper Security Configurations: Default settings, open ports, or unused services can provide attackers with unnecessary entry points.

- Lack of MFA: Without Multi-Factor Authentication, stolen credentials can give attackers instant access to accounts.

- Insufficient Logging and Monitoring: If security teams can’t see suspicious activity, breaches go undetected until it’s too late.

By identifying these weaknesses early, banks can secure their apps to ensure compliance and maintain customer trust.

Required Security Compliance for Banking Institutions

The commonly required compliance that baking organizations need to follow includes:

PCI DSS (Worldwide)

The Payment Card Industry Data Security Standard (PCI DSS) applies to any bank handling credit or debit card data. It requires strong encryption, strict access controls, and PCI DSS penetration testing for banks to find and fix vulnerabilities. If the banks do not follow this compliance, they will get fines and can also risk losing the ability to process card transactions.

FFIEC (US)

In the United States, the Federal Financial Institutions Examination Council (FFIEC) sets the benchmark for cyber resilience. Its IT Handbook guides banks on risk assessments, incident response, and regular penetration testing. FFIEC compliance isn’t optional, as examiners expect banks to demonstrate effective controls for cyber security from online banking to third-party fintech integrations.

GDPR (EU banks)

The General Data Protection Regulation (GDPR) enforces strict rules on how EU banks collect, process, and store personal data. Breaches must be reported within 72 hours (about 6 days), and penalties can reach up to 4% of global turnover. For banks, GDPR means implementing security protection measures that guarantee customer privacy and prevent unauthorized access.

DPDPA (India)

India’s Digital Personal Data Protection Act (DPDPA) brings GDPR-style obligations for banks operating in the country. It requires financial institutions to get explicit consent for data use and protect sensitive personal and financial information. Under this act, they need to prove accountability through audits and testing. Vulnerability assessment and penetration testing in banking play a central role here, helping banks stay compliant in digital services.

MAS TRM (Singapore)

The Monetary Authority of Singapore (MAS) Technology Risk Management (TRM) guidelines focus on securing financial institutions against advanced cyber threats. They require banks to enforce strong authentication and ensure business continuity in the event of an attack. MAS TRM is one of the strictest frameworks, pushing banks toward a threat-led approach rather than addressing risks after they have already occurred.

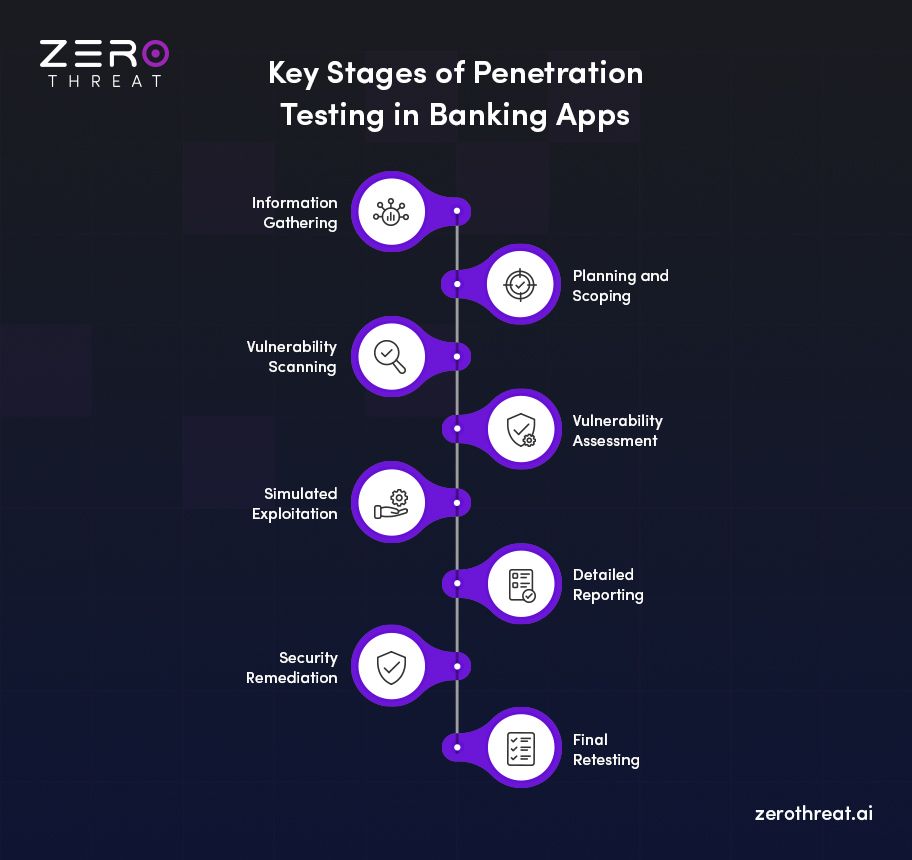

Stages of Penetration Testing for Banking Applications

Penetration testing for bank applications allows you to find the security vulnerabilities before they turn into a threat. Here are the general stages of pen testing (the stages may slightly vary based on the process you follow).

Stage 1: Information Gathering

This stage maps the banking environment from internet banking portals to APIs and backend systems. Testers collect details on domains, IP ranges, and services. The goal is to understand the attack surface and identify endpoints where critical data, such as customer credentials or payment information, could be exposed.

Stage 2: Planning & Scoping

In banking, scope defines everything. Planning ensures compliance requirements, like PCI DSS penetration testing for banks or FFIEC standards, are included. This step sets clear objectives, testing boundaries, and rules of engagement, so that no operation gets disrupted during the time of testing.

Stage 3: Vulnerability Scanning

An automated vulnerability scanning tool is used to detect common vulnerabilities across web apps, mobile apps, and APIs. While scanners flag potential risks, they don’t show the full impact. That’s the reason why auto scans are just a starting point before diving into penetration testing.

Stage 4: Vulnerability Assessment

Here, findings from scans are analyzed to determine which flaws matter most. For example, a weak encryption protocol on a banking API is prioritized higher than a minor misconfiguration. This stage helps banks focus on remediating vulnerabilities that could cause data breaches or compliance violations.

Stage 5: Simulated Exploitation

In this phase, ethical hackers attempt real-world attacks on the system. In a banking penetration testing checklist, exploitation proves whether a vulnerability can compromise security or not. It shows the actual business risk behind technical flaws.

Stage 6: Detailed Reporting

Once the testing is completed, evidence-based reports need to be created. This stage documents every vulnerability found, how it was exploited, and its potential impact. Reports also show issues with regulatory compliance for banks, helping CIOs and CISOs present results to auditors and regulators.

Stage 7: Security Remediation

After reporting, the focus shifts to fixing security issues. Remediation involves patching security, hardening APIs, and updating configurations. In banking, this is where IT teams, compliance officers, and security teams collaborate to close every identified gap.

Stage 8: Final Retesting

Once fixes are applied, retesting will allow you to confirm that the vulnerabilities have been resolved. This verification is important for protecting customer data and proving compliance with regulators. It ensures no issues remain open that could expose financial systems to future attacks.

With that, we can make sure all vulnerabilities are taken care of, and the banking system is secured. A final pen testing certificate will be provided to you, which can be used to showcase security compliance.

Cost & Frequency of Banking Penetration Testing

The cost of penetration testing in banking depends on several factors such as number of features, scope, and compliance requirements. The larger the bank, the bigger the attack surface. Attackers can exploit core banking systems and internet banking apps through APIs and cloud infrastructure.

Plus, frameworks like PCI DSS, GDPR, OWASP, FFIEC, and MAS TRM often require more rigorous testing, which increases cost. Simply put, the more complex and regulated the environment is, the higher it costs.

If we talk about the frequency of testing, it can vary based on how strict you want to work on security and compliance. Threats change daily, and compliance demands regular validation. At a minimum, pen testing should be done annually (according to PCI DSS) to meet regulatory expectations.

However, the best practice is to run it quarterly, monthly or after any system change, such as deploying new features or updating APIs.

| Testing Frequency | When It’s Required | Why It Matters |

|---|---|---|

| Annually | Minimum standard for most compliance frameworks | Meets regulatory compliance, but may miss changing threats |

| Quarterly | Best practice for banks and FinTechs | Keeps pace with new vulnerabilities and cyber threats to banking industry |

| After Major Updates | New app launches, system upgrades, or API changes | Ensures new features don’t introduce fresh attack surfaces |

| Ongoing / Continuous | High-risk institutions with complex digital banking | Provides real-time security assurance and faster fraud prevention |

With regular pen testing, you can ensure that no vulnerabilities are left behind, making your apps threat-proof.

How ZeroThreat Helps Banks Secure Their Systems

When it comes to banking, every second counts. A delay in detecting a vulnerability could mean fraud, regulatory penalties, or a breach of customer trust. That’s why banking needs a penetration testing platform built for speed, accuracy, and compliance. This is where ZeroThreat delivers with its AI-driven penetration testing solutions.

ZeroThreat helps banking institutions stay ahead with:

- 40,000+ Threats Covered: Detects both common and emerging vulnerabilities across web apps and APIs.

- 10× Faster Scans: Identifies risks in minutes, not hours, so banks can act before attackers do.

- AI-Driven Fixes: Generates clear, prioritized remediation steps for faster resolution.

- Compliance-Ready Reports: Instantly aligned with PCI DSS, GDPR, ISO 27001, FFIEC, and more.

- Zero Setup Required: Point-and-click simplicity, no expert configuration needed.

- Web & API Security in One: Protects internet banking platforms, customer apps, and APIs from a single dashboard.

Try ZeroThreat for free to learn more about how its automated pen testing tool can improve the security posture of your system and help you meet regulatory compliance.

Stay One Step Ahead of Hackers in Cybersecurity with ZeroThreat Perform a Quick Test

Final Thoughts

Penetration testing in banking is the single most practical step you can take to protect high-value data and stop fraud before it starts. If you run or secure banking apps, APIs, or core systems, you should invest in regular threat-led testing.

The basics you can do are, implement multi-factor authentication, encrypt data, and run pen tests. Meeting standards like PCI DSS and local regulations is necessary, but real security comes from proving systems resist real attacks.

When done right, penetration testing becomes an advantage; it reduces risk, protects reputation, and speeds audits.

Frequently Asked Questions

What is penetration testing in banking?

Penetration testing in banking is a simulated cyberattack on core banking apps and APIs to find and fix security vulnerabilities. You can do it using platforms like ZeroThreat, which make pen testing faster and compliance-ready, so that your banking system stays secure and audit-ready.

What systems are covered during banking penetration testing?

How often should financial institutions perform banking penetration testing?

What are the benefits of banking penetration testing?

What’s the difference between banking penetration testing and vulnerability assessment?

What tools are used in banking penetration testing?

Related Article

Explore ZeroThreat

Automate security testing, save time, and avoid the pitfalls of manual work with ZeroThreat.