All Blogs

FinTech API Pentesting: Risks, Methodology, & Best Practices

Quick Overview: API security is the key to protecting financial data in today’s digital banking and payment systems. This blog explores the best practices for API pentesting in FinTech apps, showing how security teams can identify vulnerabilities, strengthen defenses, and meet compliance requirements.

APIs in FinTech apps are nothing less than a magic tool for modern finance. It moves money, powers investments, and connects users to their financial lives in seconds. With global FinTech revenues projected to surpass $324 billion by 2026, APIs are driving innovation and scaling financial services faster than ever before.

But as APIs open doors to new opportunities, they also expand the attack surface. Studies show that nearly 27% of all cyberattacks in 2023 targeted banks and FinTech platforms, with the average cost of a financial data breach hitting $5.9 million.

That’s why penetration testing for FinTech APIs has become essential for security. Leading financial organizations now include automated API pentesting in their security checklist to prevent fraud and stay compliant.

In this blog, we’ll cover highly vulnerable risks in FinTech applications. We’ll learn stages of pentesting for Fintech APIs with a practical approach. Plus, we’ll explore the best practices for API pentesting in FinTech apps to help you strengthen security. With that said, let’s begin by understanding the importance of API penetration testing.

Start pentesting your FinTech APIs to discover hidden vulnerabilities. Run Your First Scan in Minutes

On This Page

- What is the Importance of API Pentesting in FinTech?

- Benefits of FinTech API Pentesting Testing

- Top API Security Risks in FinTech Applications

- Penetration Testing Methodology for FinTech APIs

- Best Practices for API Pentesting in FinTech Apps

- Secure Your FinTech App with ZeroThreat’s API Pentesting Tool

- Summing Up

What is the Importance of API Pentesting in FinTech?

APIs are the core behind FinTech apps. They handle everything, starting from payment gateways to digital wallets and banking integrations. But that also makes them a high-risk attack surface. If a single API has a flaw, it can expose customer data, allow fraudulent transactions, or even break security compliance, such as PCI DSS or GDPR.

Performing API penetration testing helps FinTech teams detect these weaknesses before attackers do. It simulates real-world attack patterns that target broken authentication, poor authorization, or data exposure issues. For financial apps, this is critical because even a minor vulnerability can lead to financial fraud and regulatory fines.

In other words, API pentesting supports FinTech companies to maintain user trust, protect sensitive financial data, and meet security compliance. Without it, FinTech platforms risk both reputational damage and costly penalties.

Benefits of FinTech API Pentesting Testing

Penetration testing in FinTech APIs offers several benefits to financial institutions. Here are some of the key advantages.

Protects Sensitive Financial Data

FinTech apps handle transactions, account details, and personal data. API pentesting identifies weak points that could expose this information to attackers. By closing those gaps, you ensure customer trust stays intact.

Uncovers Critical Business Logic Flaws

Many FinTech attacks don’t target code errors but flaws in how transactions or workflows are designed. Advanced pentesting can expose these logic gaps and offer you remediations as well. This allows you to prevent attackers from abusing payment flows or bypassing financial safeguards.

Prevents Fraudulent Transactions

Attackers often exploit broken authentication or poor authorization in APIs. Pentesting simulates these real attack scenarios, highlighting where fraud could occur. Fixing them reduces the risk of unauthorized transfers or account takeovers.

Ensures Compliance with Financial Regulations

Standards like PCI DSS, PSD2, and GDPR require strict API security controls. Penetration testing validates whether your APIs meet these requirements. That results in reduced chances of costly penalties or compliance failures.

Strengthens API Security Against OWASP Risks

FinTech APIs are vulnerable to OWASP API Top 10 issues, such as SQL injection and sensitive data exposure. API penetration testing checks for these specific risks and supports you in developing applications that are more resilient against common attack methods.

Supports Continuous Security for FinTech Growth

As FinTech apps scale, new APIs get added quickly. By performing regular penetration testing, you can ensure every update is tested for vulnerabilities before release. This creates a cycle of ongoing API security best practices, instead of one-time fixes.

Want to know your FinTech app security posture? Run a free test and uncover vulnerabilities before attackers do. Pentest Now

Top API Security Risks in FinTech Applications

Below are some of the most critical API security risks that expose FinTech applications to fraud, data theft, and compliance failures.

Injection Attacks

Injection flaws remain one of the biggest threats to financial APIs. Attackers insert malicious SQL or command queries into API requests to steal sensitive financial data. In FinTech, this could mean direct access to transaction records or customer details. Proper input validation and secure coding practices are essential to prevent this.

Session Hijacking

Weak session handling allows attackers to steal tokens or cookies and impersonate legitimate users. Session hijacking is severe because hijacked sessions can lead to unauthorized transfers or account manipulation. Using short-lived tokens, TLS, and proper session expiration, you can reduce the chances of this attack.

Broken Authentication

Broken authentication happens when login or token-based mechanisms are poorly implemented. Attackers can exploit these gaps to bypass logins, brute-force credentials, or reuse stolen tokens. This risk can compromise compliance and regulatory obligations tied to user identity verification.

Cross-Site Scripting (XSS)

XSS allows attackers to inject malicious scripts into an application, often through input fields or API responses. This can be used to steal session tokens, capture keystrokes, or manipulate transactions. Strong input validation, output encoding, and Content Security Policies (CSP) are essential to reduce this risk.

Broken Object Level Authorization (BOLA)

BOLA is the most critical API vulnerability in banking and FinTech apps. It happens when an API doesn't verify if a user should access specific data. An attacker can simply change an account number in the request from /accounts/123 to /accounts/456 and see someone else's data. It's a direct bypass of core financial privacy.

Server-Side Request Forgery (SSRF)

With SSRF, attackers trick the server into making requests to internal systems or external services. This attack can expose sensitive infrastructure or allow unauthorized access to banking integrations. Preventing SSRF requires strong validation and blocking access to internal network resources.

Insecure Direct Object References (IDOR)

IDOR vulnerabilities occur when APIs expose database keys, account IDs, or transaction references directly. If exploited, attackers can manipulate these references to gain access to accounts or alter transactions. To secure your FinTech app from this vulnerability, you must implement strict identity and access management (IAM) controls.

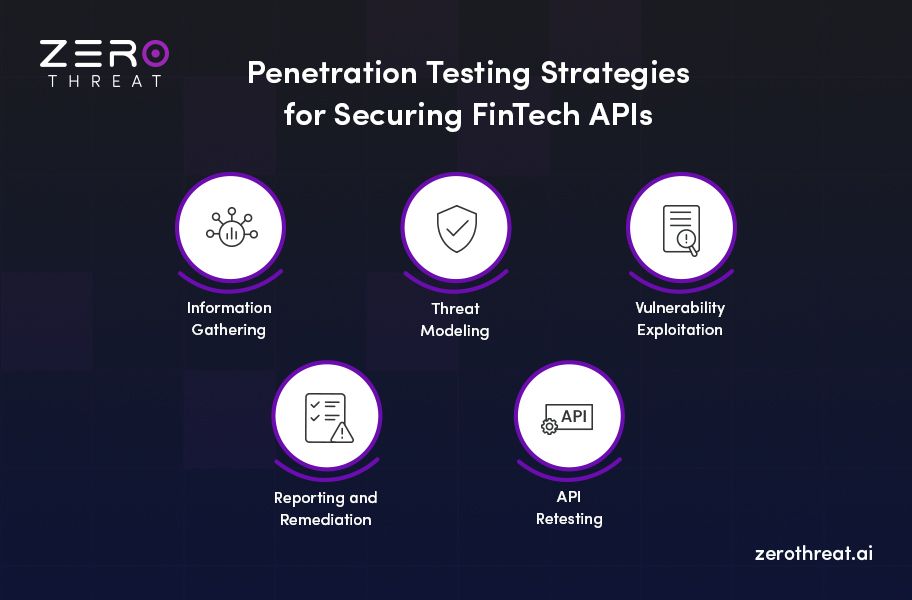

Penetration Testing Methodology for FinTech APIs

A solid methodology is what separates a meaningful security test from basic scans. Here’s a look at the key stages of pentesting.

1. Information Gathering

This stage is about mapping the API surface before testing begins. Security teams collect details like endpoints, parameters, request methods, and authentication flows. For FinTech apps, this step is critical because APIs often connect to banking systems and third-party services. The goal here is to understand where sensitive data flows and which assets attackers would target.

2. Threat Modeling

Next, we think like an attacker targeting a bank. We ask: "What's the most valuable data here?" and "How would I steal it?". This helps us prioritize our efforts on the most critical assets, like payment processing or user data. This focused approach is a core part of our penetration testing methodology for fintech APIs, ensuring we test what matters most.

3. Vulnerability Exploitation

At this stage, testers move from identifying weaknesses to actively exploiting them in a controlled environment. The aim is to understand how an attacker could use these flaws to compromise financial data or bypass API security controls. Here are the tests carried out by performing vulnerability exploitation.

- Authentication Testing: Simulates brute-force and token manipulation attacks to check if unauthorized users can log in or hijack sessions.

- Authorization Testing: Verifies whether users can perform actions beyond their access level, such as viewing or altering another customer’s account.

- Injection Testing: Attempts SQL, NoSQL, or command injections through API requests to identify insecure data handling in financial applications.

- Input Validation Testing: Sends malformed or unexpected data into APIs to test how well the system validates inputs before processing.

- Business Logic Testing: Looks for gaps in business logic workflows, like bypassing approval steps, that could allow fraud or abuse.

- Rate Limiting Testing: It floods endpoints with requests to uncover denial-of-service risks or missing API throttling controls.

- Misconfiguration Testing: Examines security settings, error messages, or exposed endpoints that may reveal sensitive information.

This stage shows the real impact of vulnerabilities, helping FinTech teams prioritize fixes based on actual exploitation potential.

4. Reporting and Remediation

At this stage, testers compile a detailed report that explains the vulnerabilities, their impact, and proof-of-concept attacks. Instead of just listing issues, the report maps them to real-world risks like fraud, data theft, or compliance violations. Some tools even provide AI-powered remediation steps, allowing developers to know and fix security gaps.

5. API Retesting

Finding a flaw is one thing; confirming it's properly fixed is another. Retesting checks whether new security gaps were introduced during remediation, which is common in complex FinTech systems. This step validates that protections like rate limiting, access control, and input validation are working as expected.

Best Practices for API Pentesting in FinTech Apps

Following API penetration testing best practices allow you to stay ahead of hackers and secure your financial applications. Here

1. Prioritize High-Risk APIs

Not all APIs carry the same risk. Focus first on endpoints handling payments, transfers, or customer personal data. Prioritizing high-impact APIs ensures that limited testing resources deliver maximum security value.

2. Simulate Real-World Attacks

Run automated penetration testing that attacks the way an actual hacker would. This type of testing will try to exploit broken authentication, manipulate workflows, and bypass authorization. It will expose business logic and API vulnerabilities that you may miss with manual testing.

3. Integrate Pentesting into Development Cycles

Embed security testing into CI/CD pipelines so APIs are tested with every release. Continuous pentesting ensures new features don’t introduce vulnerabilities and keeps your FinTech app secure as it grows.

4. Focus on Business Logic Flaws

Many breaches in FinTech aren’t due to code bugs; they exploit how transactions and workflows are designed. Analyze APIs for gaps that could allow unauthorized fund transfers, replay attacks, or transaction manipulation.

5. Collaborate Across Teams

Work closely with developers, product owners, and compliance officers. Sharing insights ensures fixes are practical and aligned with regulatory standards like PCI DSS or PSD2 for security compliance.

6. Continuously Reassess Threats

FinTech apps grow rapidly, and new APIs are added regularly. Schedule periodic reviews and retesting to tackle emerging threats, updated protocols, and third-party integrations. Continuous reassessment keeps your API secure against emerging threats.

Secure Your FinTech App with ZeroThreat’s Next-Gen API Pentesting Tool

You know why API security is critical. The real challenge is finding a testing solution that is both deeply thorough and efficient. This is where ZeroThreat transforms the process.

ZeroThreat provides a powerful, AI-assisted platform that makes expert-level API security accessible. It bridges the gap between slow, expensive manual pentests and inconsistent automated scanners.

Its API security testing tool delivers a complete vulnerability assessment at incredible speed. ZeroThreat analyzes your financial applications for business logic flaws and authorization bugs, along with OWASP vulnerabilities.

The platform guides your team from start to finish. It automatically discovers your endpoints, even the hidden ones, and executes a testing methodology based on your needs. You get a clear, AI-driven remediation report that lists problems and shows your developers exactly how to fix them.

So, stop struggling with complex manual testing processes. Let ZeroThreat empower your team to identify and remediate critical vulnerabilities before they can be exploited.

Discover and fix API weaknesses fast with ZeroThreat’s intelligence, speed, and simplicity. Start Your Free Scan

Summing Up

When it comes to money, security is non-negotiable. Your customers don’t care how sleek your features are if their data isn’t safe. That’s why following the best security practices is critical when you are developing a FinTech application.

Out of many ways to ensure security, API penetration testing allows you to detect vulnerabilities by performing a simulated attack. It makes sure that no vulnerabilities go undetected, including injection, business logic, and authentication flaws.

You can perform API pentesting for FinTech apps manually, which is a complex and time-consuming process. On the other hand, you can use ZeroThreat’s penetration testing tool for quick and accurate results.

Frequently Asked Questions

What are the most critical risks of penetration testing for FinTech APIs?

The biggest risks are exposure to sensitive data, insecure authentication, broken access controls, and business logic flaws. These weaknesses can let attackers manipulate transactions, steal financial data, or disrupt services.

What are the best practices for penetration testing in FinTech applications?

What security regulations should FinTech API penetration testing comply with?

How often should I perform penetration testing for my FinTech APIs?

Can penetration testing help with PCI DSS, GDPR, or other compliance needs?

Explore ZeroThreat

Automate security testing, save time, and avoid the pitfalls of manual work with ZeroThreat.